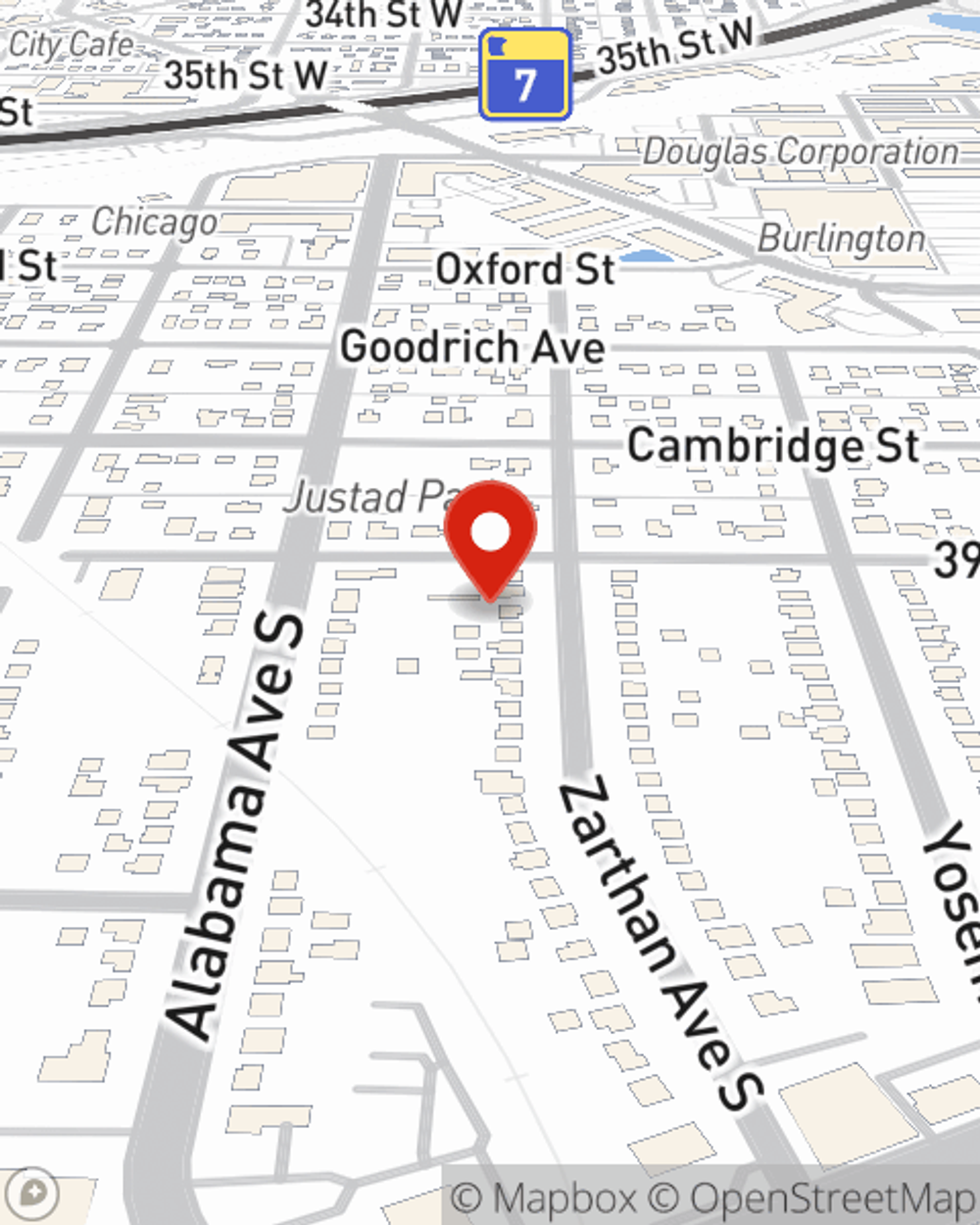

Condo Insurance in and around St Louis Park

Townhome owners of St Louis Park, State Farm has you covered.

State Farm can help you with condo insurance

There’s No Place Like Home

When looking for the right condo, it's understandable to be focused on details like needed repairs and location, but it's also important to make sure that your condo is properly covered. That's where State Farm's Condo Unitowners Insurance comes in.

Townhome owners of St Louis Park, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Home Sweet Home

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has fantastic options to keep your condo and its contents protected. You’ll get coverage options to accommodate your specific needs. Luckily you won’t have to figure that out by yourself. With empathy and remarkable customer service, Agent Patrick Loree can walk you through every step to help build a policy that shields your condo unit and everything you’ve invested in.

Finding the right protection for your condo is made easy with State Farm. There is no better time than today to contact agent Patrick Loree and discover more about your outstanding options.

Have More Questions About Condo Unitowners Insurance?

Call Patrick at (952) 546-4240 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Patrick Loree

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.